Finding effective financing solutions can prove challenging for any Software as a Service (SaaS) company. Despite the increased focus on this business model and financing solutions, many SaaS owners don’t know how to value their company accurately. Without a correct SaaS valuation, you won’t be able to get the financing options that work best for your business. We want to help you understand the SaaS company valuation process and its impact on your financing options.

How to Determine the Value of a SaaS Company?

Determining your company’s valuation can be a complex process involving outside investors’ input. However, SaaS companies’ public market valuation differs from private market ones.

For fast-growing public SaaS companies, this number is determined by the market. However, determining the value of fast-growing private SaaS companies is much more difficult. One of the best multiple-based formulas for determining the value of your private SaaS company goes something like this: annualized recurring revenue (ARR) x multiple = company value. There is not an exact science for determining the SaaS multiple. Generally, however, anything that affects future monthly revenue, cash flow, or the growth rate will be a factor.

In an article about SaaS valuation, Thomas Smale, CEO of FE International, says that “hundreds of different data points” impact the multiple. For him, “these boil down to the transferability, scalability, and sustainability of the enterprise” and include factors such as financials, traffic, operations, niche, and customer base.

Another factor that can influence the value of your SaaS business is the relationship between revenue retention and churn. A study by SaaS Capital Insights found that “for every 1 percentage point increase in revenue retention, a SaaS company’s value increases by 12% after five years.”

Conversely, churn, which is the loss of expected ARR, can reduce the valuation. Retaining revenue is particularly important to your company’s valuation because it impacts many other factors, such as your actual revenue, addressable market, and growth rate.

It is important to note that private SaaS companies have no objective valuation. So, what impact can a subjective value have on the public or private SaaS business’ ability to obtain financing?

What Impact does This Valuation Have on Financing Options?

Regardless of what type of financing options you want, your company’s value will influence the terms of your SaaS financing. For venture capital and other types of equity financing, the higher your company’s valuation, the less ownership you will have to give away.

While higher valuation generally helps you keep more equity, Jeff Erwin says you shouldn’t always choose the investor that values your SaaS company the highest. More influential firms can offer “lower valuations so they get more equity for their investment. They also bring deeper pockets for later rounds, very seasoned expertise, and relationships with companies you want to do business with.”

Further down the road, your company’s valuation will significantly impact the returns to owners when/if you try to sell your business. While choosing a lower valuation may have allowed you to obtain ideal financing options earlier, it also can limit your returns when you sell.

From https://www.saastr.com/saas-companies-can-maximize-value-debt/

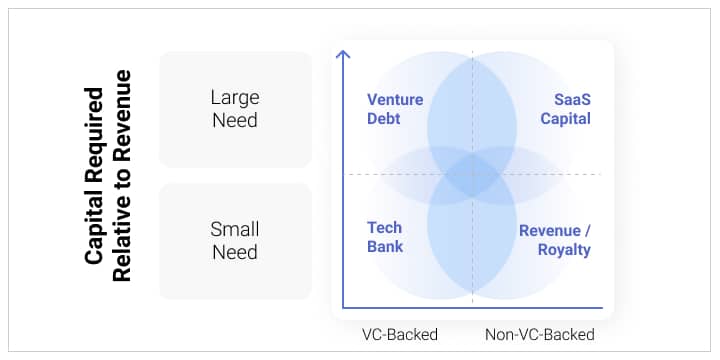

In terms of debt financing, valuation can also impact what types of interest rates, terms, and collateral requirements are included. SaaS companies can choose a variety of debt and hybrid funding options depending on their needs and expectations.

RevTek Capital – Providing Capital for innovative companies with recurring revenue

RevTek Capital provides strategic debt funding of $3MM to $30MM to innovative companies with $7MM to $75MM of predictable annual recurring revenue. The funding is used for sales growth, acquisitions, and enhancing infrastructure for scaling operations. Each company’s debt structure is customized to optimize its unique accomplishments and circumstances.

Many startup companies struggle to raise capital and have found the process to be quite time-consuming. Our organization has unique insights regarding SaaS businesses and the challenges these and other tech-enabled companies encounter. In addition, the professional team at RevTek has many years of experience in marketing and operations that may assist our clients.

Key Benefit Summary

- Cost-effective capital for growing tech-enabled companies

- The company leadership retains control

- Recurring revenues serve as the collateral for financing

- Repayment is structured into simple and manageable monthly payments

- You have faster access to funding – closing in as little as four weeks

We look forward to the opportunity to partner in growing your business!