Finding effective financing solutions can prove challenging for any Software as a Service (SaaS) company. Because SaaS is a relatively new business model, many SaaS owners do not know how to value their companies accurately, as there is no one-size-fits-all equation or standard.

These figures are crucial for long-term selling plans and the present as you try to grow your business. Without a correct SaaS valuation, you will severely limit the financing options available for your business. We want to help you understand SaaS company valuations and the impact they have on your financing options.

How to Determine the Value of a SaaS Company?

Determining the valuation of your company can be a complex process that involves the input of outside investors. However, SaaS companies’ valuation on public markets differs from those of private markets, pure-play, and B2B SaaS companies.

For fast-growing public SaaS companies, this valuation number is easily determined. The most common formula for SaaS companies on the public market is Enterprise Value (EV) divided by annual revenue. The Enterprise Value is determined by adding equity and debt and subtracting all cash on the balance sheet.

However, determining the value of high-growth private SaaS companies is much more difficult. One of the best multiple-based formulas for determining the value of your private SaaS company goes something like this: Annualized Recurring Revenue (ARR) x multiple = Company Value.

Factors that Affect the Valuation of a SaaS Company

Multiples

The difficulty with SaaS is that there is not an exact science for determining the SaaS revenue multiple. A multiple is an agreed-upon determined number that will be multiplied against the revenue to determine the value number. To develop this number, anything that affects future monthly revenue, cash flow, gross margins, or the growth rate will be a determining factor.

In an article about SaaS valuation, Thomas Smale, CEO of FE International says that “hundreds of different data points” impact the multiple. For him, “these boil down to the transferability, scalability, and sustainability of the enterprise” and include factors such as financials, traffic, operations, niche, management teams, and customer base. Deciding which multiples to use for your valuation will largely impact the outcome.

Revenue Growth

Another factor that can influence the value of your SaaS business is revenue. Your company’s revenue retention and growth over the last 12 months to 24 months can give great insights into how your company will continue to grow. A study by SaaS Capital Insights found that “for every one percentage point increase in revenue retention, a SaaS company’s value increases by 12% after five years.”

Retaining revenue is particularly important to your company’s valuation because it impacts many other factors, such as your actual revenue, addressable market, and growth rate.

Churn

Conversely, churn, the loss of expected ARR due to loss of customers or subscriptions, can lead to negative valuation. Some churn is always expected, but if churn increases year over year, your company will not be valued at a high profitability rate.

What Impact Does This Valuation Have on Financing Options?

Regardless of the financing options you seek, your company’s value will influence the terms of your SaaS financing. For Venture Capital and other types of equity financing, the higher the value, the less ownership you will have to give away.

While higher valuation generally helps you keep more equity,

you shouldn’t always choose the investor that values your SaaS company the highest. More influential firms may offer lower valuations but can bring expertise and relationships that will ultimately increase the company’s value over time.

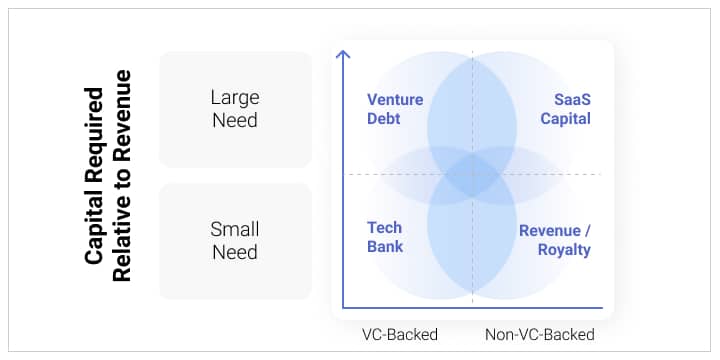

In terms of debt financing, valuation can also impact what types of interest rates, terms, and collateral requirements are included. As the chart below shows, SaaS companies can choose from various debt and hybrid funding options depending on their needs and expectations.

From https://www.saastr.com/saas-companies-can-maximize-value-debt/

SaaS Company Valuation

Further down the road, the valuation of your company will have a significant impact on your returns to owners when you try to sell your business. While choosing a lower valuation may allow you to obtain ideal financing options earlier, it also can limit your profits. Therefore, it is wise to weigh the cost against your plans for the future.

How does RevTek Finance SaaS Companies?

Here at RevTek, our goal is to give you the best possible financing model to increase your SaaS business’s valuation. Our model is simple: we provide you with the growth capital that you need to expand your business’s operations (and, therefore, the value) in exchange for manageable monthly payments based on your monthly recurring revenue.

We don’t need a seat on your board; our terms and execution are simple. You needn’t be profitable to be eligible, but you should have a predictable recurring revenue.

To begin a conversation about how to use your SaaS company valuation to gain financing in order to grow to the next level, contact us to schedule an appointment.