RESOURCES - BLOG POSTS

RevTek Capital’s resources reflect our commitment to supporting innovative companies‘. Our experts provide professional guidance to navigate the funding process efficiently to build value and growth.

Blog Posts

Decoding the Dynamics of the SaaS Customer Lifecycle

The SaaS customer lifecycle is inclusive of three stages – acquisition, engagement, and retention. Each stage allows you to understand the current mindset of your customers and helps you build strategies that encourage them to move to the next stage.

4 Common SaaS Marketing Mistakes (And How to Avoid Them)

Mistakes in SaaS marketing increase the cost of your marketing efforts without the growth and improvement that is supposed to follow. By avoiding these common mistakes and using these strategies, you will be able to not only stay ahead of your competition but ensure these mistakes won’t happen down the line in your company. Check out this article about 4 common SaaS marketing mistakes and how to avoid them by us here at RevTek Capital.

SaaS Company Valuation: Multiples and More

Overall, valuing a SaaS company requires a thorough understanding of its financial metrics, growth potential, and competitive landscape. By considering these factors, investors and potential acquirers can determine a fair value for the company.

Check out this article about SaaS Company Valuation: Multiples and More by RevTek Capital. If you enjoyed the article, make sure you download our FREE e-book and subscribe to our email listing at the end of this article!

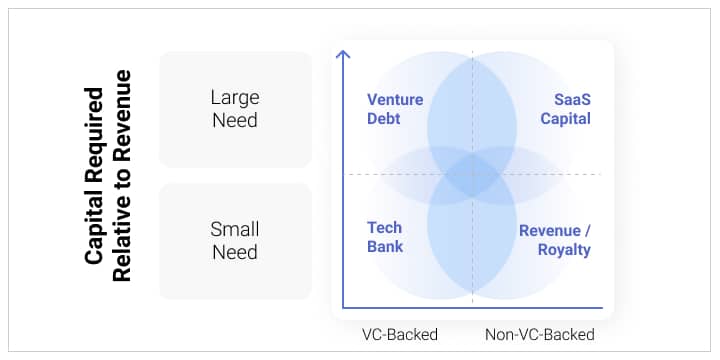

How to Qualify for SaaS Financing

Qualifying for SaaS financing can be a challenge, but there are steps you can take to increase your chances of approval. Overall, the key to qualifying for SaaS financing is to be prepared, organized, and able to demonstrate that your business is a good investment.

SaaS Marketing Strategies: 2024

Until the recent past, business and marketing models have been built around companies trying to sell a physical product. They want you to buy the newest car, the best watch, or even that tendy, eco-friendly, hand printed tee.

These all have one thing in common: they are items.

In the world of items, a one-time purchase is all you need to close a sale and call it a success. Sure, repeat customers are important, but they are not necessarily the backbone of your business operation– especially as the price per item rises.

In SaaS, the game changes.

Top 10 SaaS Trends: 2024 Edition

The Software as a Service industry has taken the tech world by storm in recent years and is creating a digital transformation that permanently changes the world of technology and software development.

SaaS Company Valuation and how it affects Financing

For any Software as a Service (SaaS) company, finding effective financing solutions can prove difficult. Despite the increased focus on this business model and financing solutions, many SaaS owners don’t know how to accurately value their company. Without a correct SaaS valuation, you won’t be able to get the financing options that work best for your business. We want to help you understand SaaS company valuations and the impact that has on your financing options.

How to leverage SaaS Subscription Revenue to meet your Valuation Goals

As SaaS businesses evolve, recurring revenue models are key drivers of valuation. Check out his article on how to leverage the power of SaaS subscription-based strategies to accelerate your company’s growth and investor appeal.

Popular Articles more...

SaaS Onboarding Best Practices

Did you know SaaS companies lose 75% of new users within the first week without effective onboarding?

In this article, you’ll learn SaaS onboarding best practices, so users understand how your product

SimSpace Closes $22.6 Million Financing Round

April 2023 Phoenix, AZ — SimSpace, a leading cybersecurity company that offers the world’s most advanced open cyber range, providing its customers everything they need to keep their security team, processes, and

A Look at the Future of SaaS Investing

The Software as a Service (SaaS) industry is in the midst of a dynamic growth phase, attracting substantial investments in recent years. According to the findings of a comprehensive report by Grand

How to leverage SaaS Subscription Revenue to meet your Valuation Goals

As SaaS businesses evolve, recurring revenue models are key drivers of valuation. Check out his article on how to leverage the power of SaaS subscription-based strategies to accelerate your company’s growth and

We devote the time to understand your accomplishments, circumstances, and opportunities to create a customized debt funding structure to accelerate your growth.