Understanding Cost of Sales (COS) in SaaS: How to Measure, Benchmark, and Optimize for Growth

In a SaaS business, growth is not just about acquiring customers—it’s also about how efficiently you deliver your service. One of the most important financial metrics in this equation is Cost of Sales (COS), sometimes referred to as Cost of Goods Sold (COGS).

This article explores what COS means in SaaS, how to calculate it, what to include or exclude, and how to benchmark and reduce it for long-term success.

What is cost of sales in a SaaS company?

Cost of Sales in SaaS includes all the direct costs required to deliver your software product to customers. Unlike physical products that involve inventory and materials, SaaS companies must focus on the digital infrastructure and support systems that make software delivery possible.

Common COS components include:

- Hosting services (like AWS, Azure, or Google Cloud)

- Customer support and onboarding

- DevOps or infrastructure engineers

- Bundled third-party software tools or APIs

If removing the cost negatively impacts your ability to deliver your software to customers, then it likely belongs in your COS.

What should be excluded?

SaaS COS should not include:

- Sales and marketing expenses

- Executive salaries

- General and administrative overhead

- Research and development

COS focuses solely on what it costs to deliver your product to the user—not to acquire, upsell, or retain them.

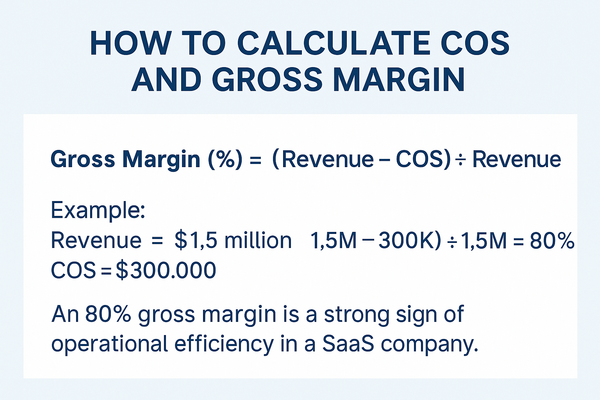

How to Calculate COS and Gross Margin

To calculate your COS, add together all direct service delivery expenses for a specific period. Then use the following formula to calculate your gross margin:

SaaS Industry Benchmarks for COS and Gross Margin

According to industry reports from SaaS Capital, CloudZero, and The CFO Club, SaaS companies should target the following benchmarks:

Lower COS percentages typically reflect more efficient operations and create more cash for reinvestment into growth.

Why COS Matters for SaaS Capital and Scalability

COS directly affects your gross margin. The higher your margin, the more capital you retain for growth, salaries, and reinvestment. For venture capital or alternative financing partners like RevTek Capital, a healthy COS-to-revenue ratio signals good business health and scalability.

Efficient COS reporting also increases transparency for investors and allows founders to negotiate better funding terms.

To learn how RevTek Capital helps SaaS companies scale while preserving equity, visit our story.

Practical Ways to Reduce SaaS COS

Here are several strategies SaaS companies can use to reduce COS while maintaining service quality:

1. Optimize cloud infrastructure

- Use reserved instances

- Eliminate underutilized resources

- Implement auto-scaling

2. Review third-party tools

- Consolidate overlapping software

- Renegotiate vendor contracts

3. Streamline support operations

- Use automation and self-service portals

- Develop onboarding materials to reduce time per customer

4. Invest in infrastructure automation

- Use DevOps tools and observability platforms

- Reduce manual intervention through efficient CI/CD pipelines

Over time, operational efficiency in these areas can contribute to significantly stronger margins.

Making COS Work for You

Understanding and controlling your SaaS Cost of Sales is more than a finance exercise—it’s a growth strategy. High margins give you the power to scale faster, reinvest strategically, and position your business for sustainable success.

Why Founders Choose RevTek Capital

Our approach is simple: We fund innovative founders with growing companies.

We provide growth capital ranging from $2 million to $20 million to SaaS companies generating $5 million or more in annual recurring revenue (ARR). With our funding, founders can:

- Expand into new markets and scale operations while preserving equity

- Invest in product innovation and build cutting-edge solutions

- Strengthen sales and marketing strategies for accelerated growth

- Hire top-tier talent to drive competitive advantage

At RevTek Capital, we believe founders should own more of their company at exit, not less. Unlike many venture capital firms that push for aggressive dilution, we provide capital that preserves founder equity while fueling expansion. We structure the terms to provide the capital you need, and when ready, you can add more growth capital quickly.

Looking Ahead: The Future of SaaS Funding

The SaaS industry is evolving at an unprecedented pace and opening new frontiers for software innovation.

At RevTek Capital, we are committed to fueling the next generation of SaaS Founders by providing the capital and strategic support needed to turn bold ideas into market-leading companies.

If you are a SaaS Founder looking to accelerate growth, let’s talk. Your success is our mission.

Let’s build the future of SaaS together.