Mastering Churn Rates in SaaS: How to Reduce Losses and Accelerate Growth

In the ever-expanding world of Software as a Service (SaaS), achieving optimal growth often comes down to one critical factor: customer retention. While launching the perfect product and attracting loyal users is the goal, churn—the percentage of customers who cancel subscriptions—can severely impact your business’s success.

RevTek Capital, your friendly founder capital source, understands the importance of monitoring churn rates, and we’re here to guide you through the process. Let’s dive into why churn matters, how to calculate it, and how RevTek Capital can help your SaaS business grow by educating you on churn analysis and providing the right resources to minimize it.

What is Churn?

Churn refers to the percentage of customers who cancel their subscriptions or stop doing business with a SaaS company. In subscription-based models, churn directly affects Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and ultimately, the entire business’s growth trajectory.

When customers leave, it’s not just the immediate revenue loss that’s concerning. High churn rates can hinder future revenue predictions, disrupt product development cycles, and damage brand reputation. For SaaS businesses, where keeping customers is more cost-effective than acquiring new ones, churn management is crucial.

Current Trends in SaaS and Churn: The SaaS industry is evolving rapidly. With an estimated compound annual growth rate (CAGR) of 23% in 2025 (Link), companies are under increasing pressure to maintain customer loyalty and manage churn effectively. New technologies such as AI and machine learning are transforming SaaS products, allowing businesses to provide more personalized experiences. However, these same advancements also mean heightened competition, making retention even more critical.

Understanding churn—and acting on that knowledge—is vital for SaaS businesses seeking long-term success. RevTek Capital is here to help guide you through the complexities of churn analysis, offering both capital and strategic advice for minimizing losses and achieving accelerated growth.

Why Is Churn Rate Crucial for SaaS Business?

1. Impact on MRR and ARR:

Churn doesn’t just affect the customer count—it impacts your revenue. By calculating churn accurately, you can determine the precise amount of Monthly Recurring Revenue (MRR) lost over time. This insight helps you understand the financial health of your business and adjust accordingly.

2. Affects Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC):

High churn increases your Customer Acquisition Cost (CAC), as you need to invest more in marketing and sales to replace lost customers. A lower churn rate, on the other hand, helps your Customer Lifetime Value (LTV) grow, making each customer more valuable in the long term.

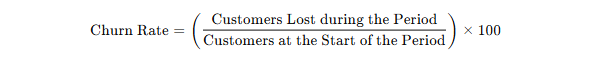

How to Calculate Churn Rate

Calculating churn is simple, but interpreting the data requires strategic action. The churn rate formula is:

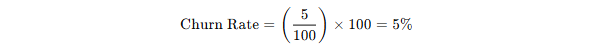

For example, if you start January with 100 customers and lose 5 customers during the month, your churn rate for January is:

But here’s the catch—although you can calculate churn, minimizing it is where the real value lies. An ideal churn rate is as close to 0% as possible. Companies that have successfully reduced churn are typically more profitable, have stronger brand loyalty, and achieve more sustainable growth.

What is an Acceptable Churn Rate?

While many SaaS leaders may ask, “What’s a good churn rate?” the truth is that no churn is ideal. The goal should always be to aim for the lowest possible rate. Businesses that focus on keeping their existing customers, improving customer service, and evolving their products based on user feedback see better long-term growth.

However, churn is a reality for every business. Rather than seeing it as a negative, consider it an opportunity to learn about your customers’ needs and identify areas for improvement in your product or service. As John Maxwell says, “Make the most of your mistakes and see them as assets rather than liabilities.”

Types of Churn

There are several reasons customers leave, and understanding these can help you tailor your retention strategy. We categorize churn into four types:

1. Voluntary Churn:

-

- This occurs when customers cancel their subscriptions voluntarily. Reasons can include budget cuts, product ineffectiveness, poor customer service, or the appeal of competitors.

- Focus: Reduce voluntary churn by improving customer experience and adding value.

2. Involuntary Churn:

-

- Involuntary Churn happens automatically, often due to expired credit cards, failed payments, or a missed renewal. Customers may not even realize they’ve been churned.

- Focus: Implement better billing systems and proactive customer support to catch issues early.

3. Subscription-Level Churn:

-

- Here, customers downgrade to a lower-tier plan, reducing their revenue contribution without leaving entirely.

- Focus: Ensure your plans and pricing tiers are aligned with customer needs, and provide incentives to retain high-value customers at premium levels.

4. Seasonal Churn:

-

- Some churn is tied to specific times of the year or market trends. Certain customers may need your service during peak seasons and not at other times.

- Focus: Monitor churn patterns and develop strategies to manage it, like offering seasonal discounts or customized plans.

How Churn Affects Your Business

Churn affects several key metrics:

- MRR and ARR: When customers cancel, your revenue shrinks.

- LTV and CAC: High churn forces you to spend more on customer acquisition to replace lost clients.

- Customer Engagement: Churn can signal disengagement, which may reflect a deeper issue with your product or customer service.

By closely monitoring churn, you can identify its root causes, improve your product, and strengthen customer relationships, thereby improving your MRR, LTV, and overall growth potential.

Reducing Churn for SaaS Growth

Understanding and managing churn is a critical aspect of SaaS growth. At RevTek Capital, we believe that by effectively analyzing churn rates, implementing customer retention strategies, and providing the capital you need, we can help your SaaS business thrive.

Together, we’ll turn churn from a challenge into an opportunity, allowing you to accelerate growth and build stronger customer loyalty. Ready to reduce churn and unlock your SaaS business’s full potential? Reach out to RevTek Capital today.