When starting an SaaS company or growing your existing business, there are several moving parts to keep in mind. For one, the SaaS model works unlike any other standard business structure with many quirks and nuances one must be aware of when assessing the financial implications of growing the business. Furthermore, because SaaS is subscription based, business owners need to assess cost of customer acquisition and expansion over time– no easy task when assessing the various factors that contribute to profit and loss, churn rates, and the overall longevity of the customer.

Below is an in-depth look at some key factors in growing your SaaS business, which metrics are the most important to keep in mind, and how to assess them together to develop the best plan for sustained forward momentum.

What Makes the SaaS Model Unique

Unlike business models that rely on the sale of an item, SaaS companies rely on the sale of a service. As such, traditional business models that rely on single-purchase clients is not enough to sustain and achieve long-term expansion goals.

When developing a business model for SaaS companies, you have to take several metrics into account to determine not only how many new clients you are earning, but how many clients are choosing to continue their subscription to your software.

This makes the challenge of SaaS marketing twofold: you not only have to find new customers, you need to find the customers who are right for your service.

Below are the top metrics to use when determining what is (or isn’t) working to help grow your business.

The Basics

To make discussing these various topics easier going forward, there are a handful of key metrics to learn about. These are going to be the main metrics you use when calculating projected growth, financial needs, and assessing valuable client information to help you generate more accurate leads to help target the correct niche for your service.

MRR, ARR, ACV

This stands for, Monthly Recurring Revenue, Annual Recurring Revenue, or Annual Contract Value, respectively.

MRR and ARR are used when your service generates revenue using a recurring subscription. ACV is used when your service generates revenue by fulfilling contracts.

In all three cases, these metrics represent the recurring revenue of various clients or contract types. Which one you use depends largely on which service and subscription style you provide.

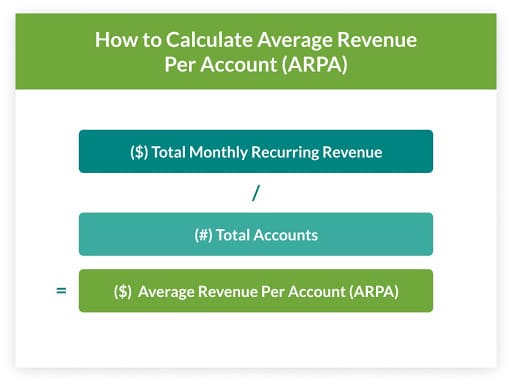

ARPA/ARPU

This metric signifies Average Revenue Per Account or Average Revenue Per User.

This metric becomes particularly important when offering packages or tier subscriptions as it better describes the revenue value of each client. For instance, Out of 100 customers, if 10 are regularly subscribing to your top tier product, they will hold a higher percentage of your total revenue. When you are able to identify which clients fall into this category, it allows you to put more resources into retaining their business and gaining new clients with similar needs.

CAC

This stands for Cost to Acquire Client.

Generally speaking, this metric encompasses any revenue that is put into generating leads and marketing to potential clients up until they subscribe to your service.

Revenue Churn vs. Customer Churn

Churn is a term used to indicate the point where a client either downgrades to a less expensive tier or stops using your service all together.

Customer Churn is when you lose an individual. Revenue Churn is when you lose the associated revenue with a given account. The reason these are in two separate categories is that not all customers generate the same amount of revenue.

For this reason, Churn and ARPA go hand in hand. By assessing your ARPA and looking at the number and revenue lost by churn rates, you will be able to determine a general idea of whether or not your current churn rate is sustainable, is leading to a growth plateau, or will start putting your business in reverse.

LTV

This is your Lifetime Value of a client.

Here, you will factor in the ARPA of a given client and divide it by their churn rate. This leaves you with a general value of the client– i.e. how much revenue they generated over the duration of their time subscribed to your service.

Customer Engagement Score

Finally, Customer Engagement Scores serve as an indication of how your customers are interacting with your product. Determining how customers are engaging with your product helps predict the potential churn rate or a given client or demographic.

For instance, a customer who does not use your service often or does not utilize all its features is more likely to churn than a client who incorporates your software into their daily work flow.

This is concrete and logical data that is used to make better assessments on what clients are in your niche. After making this assessment, you can put your resources to better use– developing and refining your marketing strategy to be more appealing to your customer base and resulting in a higher acquisition of long-term clients.

The Impact of “Churn” Rates

While all the metrics listed above work in harmony to create a comprehensive analysis of your company, churn rate is arguably the most important metric to assess.

When determining the needs and financial viability of an SaaS company, churn rates can give you valuable information on what is performing well, or poorly, within your product in addition to helping predict your net financial position.

When expanding an SaaS company, both account and revenue churn should be tracked over time. Once this number stabilizes, factor it in to your monthly profit margin to help determine how it offsets your revenue growth. This will allow you to determine if you are acquiring and retaining customers at a steady enough rate to still draw a profit.

Note that high churn rates are never a good sign in either category. If you are faced with churn rates that are above 2%, it may be time to take another look at your software and sales process to see if the product itself is faulty or if you are marketing to an incorrect demographic.

Calculating Your Net MRR/ARR

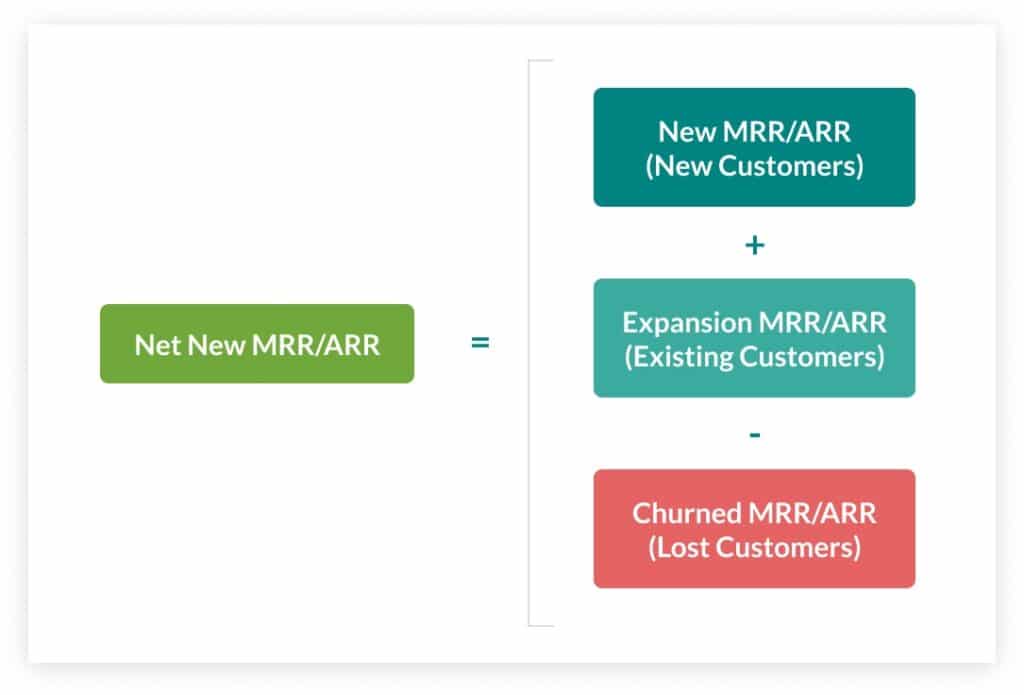

Calculating your net MRR is a simple process which gives great insight into how your business is performing.

To calculate this key metric, determine a period of time you wish to examine– let’s say a month– and determine your baseline MRR at the beginning of that time. Once the month is over, re-examine your MRR by adding in any new customers, account upgrades, and other incoming revenue. Then, subtract from this figure any negative revenue such as account downgrades, churned customers, and overall churned revenue.

Planning Ahead: Not Your Average P&L Curve

When determining the level of funding needed to expand your SaaS company, there are some quirks about start-up costs you will need to take into consideration.

Unlike in other businesses, SaaS often requires more front-end financial commitment than most start-ups. In fact, in the early months of growing your business, it is normal (and even expected) to be functioning at a negative profit.

This is an SaaS specific quirks– when you are beginning to grow your company expect a greater loss margin at first. In fact, companies which lean into this lost and continually reinvest their profits in the short term into sales tactics and lead generation often see larger growth down the road, even though in the present moment they often need a little more funding to get the project going.

In order to combat this, you want the fewest number of months to recover your CAC as possible. The shorter your turn-around time, the quicker you will recover your initial expenses.

Important metrics to assess when determining the financial implication of investing in marketing to grow your client base is your LTV and your CAC. These metrics will give insight into the efficacy and efficiency of your client acquisition methods in addition to your ability to retain them.

The Upsell: Variable Pricing

Customers and businesses alike benefit from tiered service systems– it allows companies to target high-paying customers while also allowing clients to get the most bang for their buck.

There are a few principals at play making variable pricing a logical next step for growing SaaS businesses:

It is easier to sell to existing customers than new customers

When working with SaaS, it is important to make your service integral to the workflow needs of your clients.

Once they build your software into their routine, these customers will be far more likely to continue purchasing more featured and advanced versions of your product that cater to their needs. This allows them to continue working with familiar platforms that provide them with necessary services while keeping them engaged with your services.

It increases customer lifetime and reduce customer churn rate

When customers begin to rely on your service as a way to support their workflow, they will often stay with your company for the long haul. This means their overall LTV to CAC ratio is much lower, resulting in each client bringing in a higher profit margin than before.

It creates the opportunity for upfront payments and promotions

Finally, tiered and variable pricing allows you to offer promotions that can win upfront payment.

One popular example of such promotions is offering clients a reduced rate on a monthly service by asking for a year payment upfront. Not only will this secure a lower churn rate and higher LTV for that customer, but it will also give you more funding to work with in the short term. These funds can be put toward covering financial shortages during the initial expansion process while leaving room to further invest in lead generation, marketing, and sales.

When You Need a Funding Boost

Many times what gets in the way of a SaaS company reaching their full growth potential is not having the funds to function at that initial negative profit while leads and sales are being discovered.

At RevTek, we take qualifying companies and help them reach their expansion goals by giving them the financial support where it’s most needed. With a full staff of experienced entrepreneurs, we can help businesses assess their strengths, weaknesses, and help them refine and achieve their goals.

To begin the conversation about how to take your business to the next level, connect with our team to schedule an appointment.